From Unbundled to Unified: Why Fintechs Are Reassembling the Bank

Fintech got foothold by unbundling from BFSI, and now are bundling for horizontal revenue growth

TECHNOLOGY

12/30/2020

Fintech drove the financial services industry transformation by adopting to consumer digital experience expectations and data-driven innovations. Traditional universal banking providers were more focused on meeting regulations/compliance and few invested in digital innovation teams (checkmark to boards). However, markets are fast-moving and it appears that Fintech is on a path of rebundling financial services. Till now revenues and market share of all participants have increased, but if there are universal Fintechs (or a Big Tech jumps in), then the financial services market is going to structurally change for benefit of consumer.

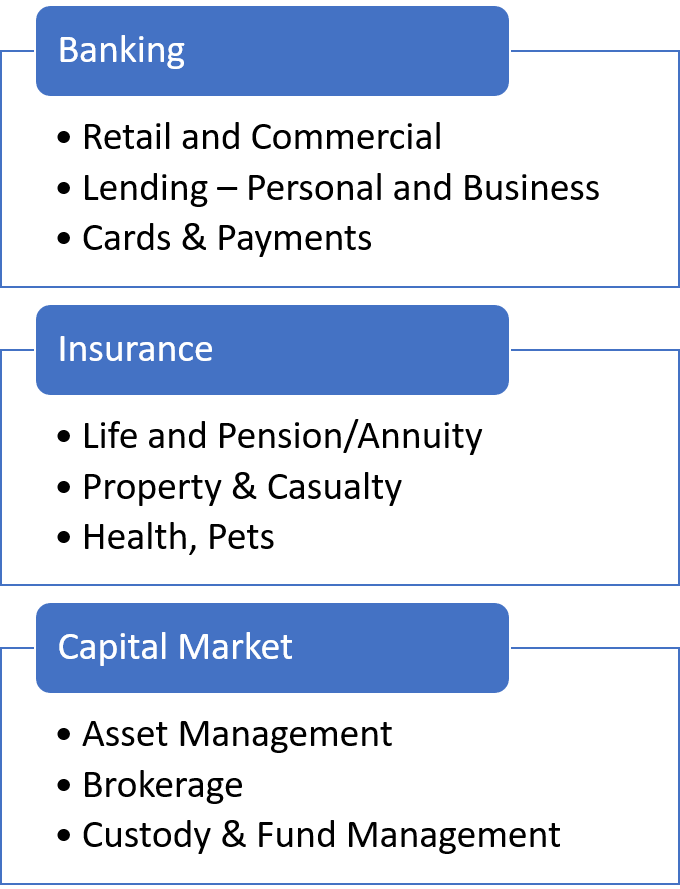

BFSI were driving to become Universal Financial Service Provider -- all in one shop

Providers strived to offer bundled products and services on disparate, legacy platforms, Individual LOB platforms, individual consumer facing SoR, few common Platforms, LOB infra platforms - structured around bank’s delivery channels

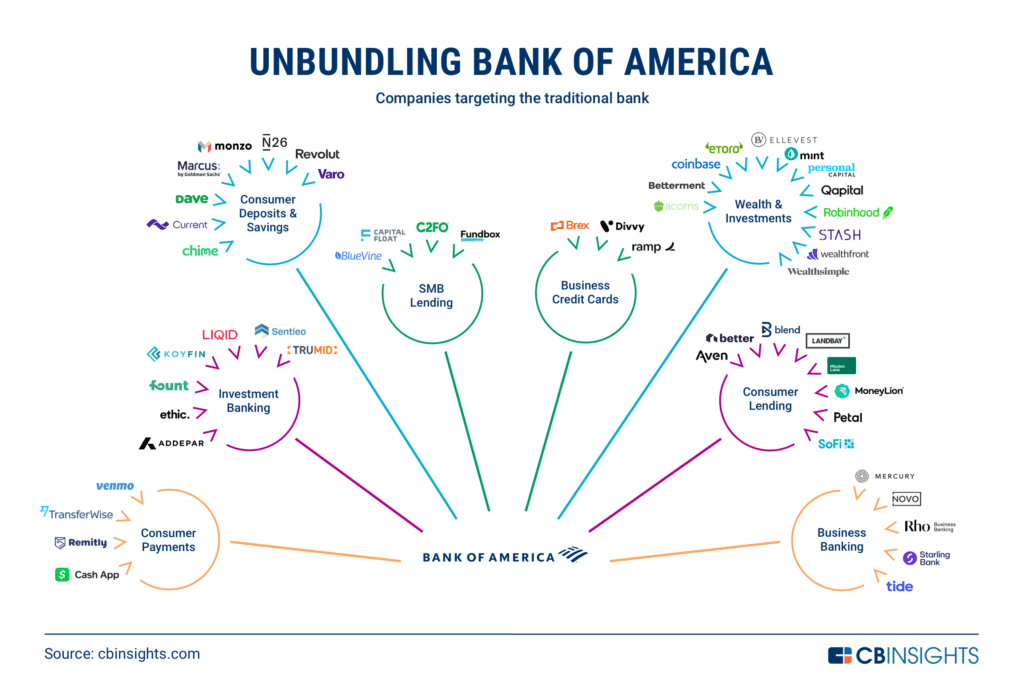

FANG++ set consumer's digital expectations - Fintech understood consumer pain, addressed friction points, and unbundled banks by offering any-time, any-where, any-device delivery of its services

Fintech unbundled the leaders in BFSI by:

Offering mobile first experience

Hyper focused on single use-case/market/experience

Focused Targeting (Underserved, Student, Fractional use, Student, near-prime, usage based)

Algorithmic (Robo advisory, lower costs)

API’s, Microservices, Cloud Native, no legacy, User Centered Design

Avoid Multiple Apps/websites to visit- no longer fragmented customer journey

Fintech moving to bundling more offering

Having established a customer base, fintech's are now growing their offerings and looking more like tradition BFSI providers. BFSI providers are also creating inhouse/partnering fintech to grow to become Universal service provider. Interesting to watch how a major tech companies gets regulatory approval to challenge.

Fintech Way

Start and establish one service and establish consumer relationship

Capture consumer data, enrich consumer identity, build own AI/credit scoring data model

Leverage own data models to re-bundle services around the consumer

Leverage open standards – Open Banking, PSD2 or establish them to take leadership

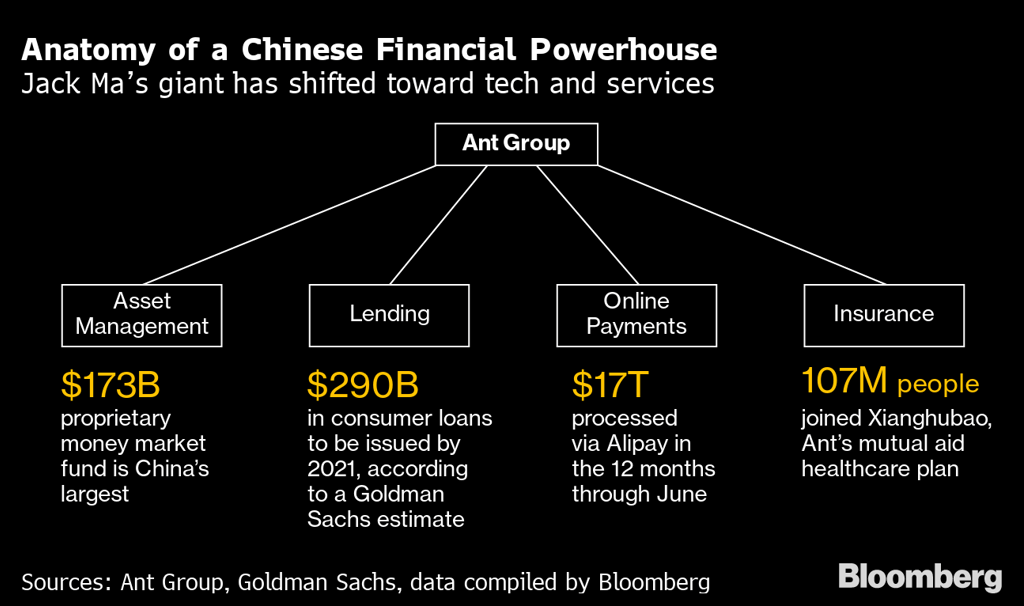

Few breakout fintech 2.0 – Ant, GS-Marcus, SoFi, Stripe, Square